Daily Market Comment – Markets calm before the central bank storm

Massive week begins, featuring rate decisions in US, Europe, and Japan

US inflation report also on tap tomorrow, could influence Fed decision

Yen hits seven-year low against pound, Turkish lira goes into freefall

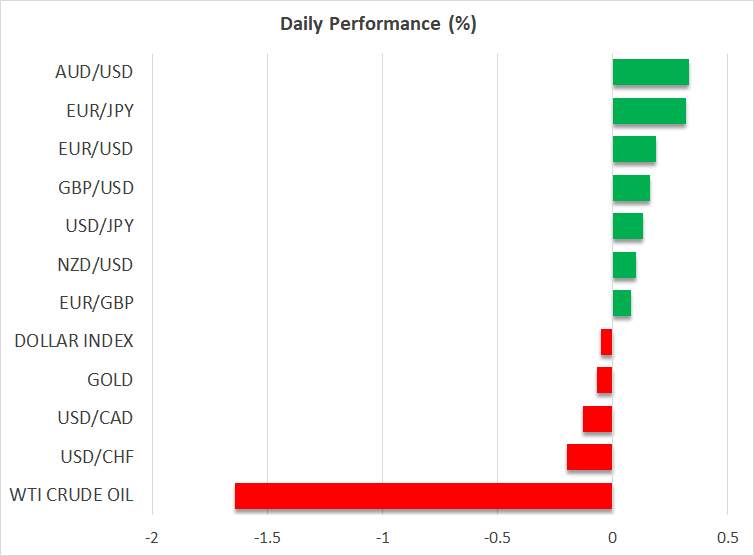

Calm ahead of key events

A bombshell week lies ahead for global markets. Interest rate decisions in the United States, Eurozone, and Japan will almost certainly fuel volatility in every asset class, especially if the rhetoric of these central banks deviates from the prevailing market consensus.

In the United States, the ball will get rolling tomorrow with the release of the latest CPI inflation data, which will be instrumental in shaping expectations around the Fed decision on Wednesday.

Even though the US economic data pulse is still pretty strong, with the labor market in good shape and GDP growth on track to hit 2% this quarter, market pricing only assigns a 25% probability for a rate increase this week. That’s because several Fed officials have signaled they prefer to ‘play it slow’ and examine incoming data before raising rates again.

Unless something dramatic changes after tomorrow’s CPI data, the Fed will probably ‘pause’ the tightening cycle this week, shifting the emphasis to the updated rate projections and any messages about the likelihood of resuming rate hikes in July. Hence, the reaction in the dollar will depend on several elements, including also how foreign central banks behave.

ECB could disappoint euro

Over in the Eurozone, the economy has fallen into a technical recession but that’s unlikely to stop the European Central Bank from raising rates on Thursday. A rate increase of 25bps is fully priced in, as the ECB has telegraphed its intentions well in advance.

Therefore, this meeting will be about how the ECB wishes to move forward. Market pricing suggests another rate hike is in the pipeline for July, yet the central bank might refuse to pre-commit to that, as incoming data suggest economic growth is rolling over and inflation is cooling.

Under these circumstances, the ECB is more likely to preach caution and patience, keeping its options open. The economy is already contracting and the last thing the central bank wants is to pour gasoline on the recessionary fire. If the ECB mimics the Fed and signals it might ‘take a break’ next month, the euro could be left disappointed.

GBP/JPY reaches highest levels since 2016

The past few months have been a perfect storm for pound/yen, which is trading at its highest levels since 2016, turbocharged by a blend of central bank divergence and favorable risk sentiment. Rate differentials have widened lately as investors bet the Bank of England will be forced to keep tightening but the Bank of Japan won’t join the race anytime soon, and the euphoric tone in stock markets has been similarly advantageous for risk-correlated FX pairs.

What the BoJ does on Friday could decide whether the yen keeps sinking. The Japanese economic landscape has improved by leaps and bounds, but it’s likely too early for the BoJ to hit the tightening button as many officials are concerned the recent victories on inflation and wages won’t be sustained. If the BoJ remains sidelined, that would leave the yen at the mercy of external forces, namely how risk appetite evolves.

Finally, the Turkish lira has gone into freefall, hitting another record low this week. The appointment of Gaye Erkan as central bank governor on Friday did nothing to calm the currency crisis, despite speculation she could triple interest rates to 25% from 8.5% currently. It seems even the prospect of dramatically higher rates is not enough to soothe investors' concerns, given the risk that such a sharp tightening in credit conditions will ultimately produce a recession.

相关资产

最新新闻

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。