Will a slowdown in UK inflation change the BoE’s plans? – Forex News Preview

Just last week, the BoE decided to hike rates by another 25bps as was widely anticipated, keeping its forward guidance more or less unchanged, namely that should inflation pressures persist, they will not hesitate to raise rates further. However, the spotlight was thrown on the upside revisions in the economic and inflation projections, with the Bank abandoning its call for a recession.

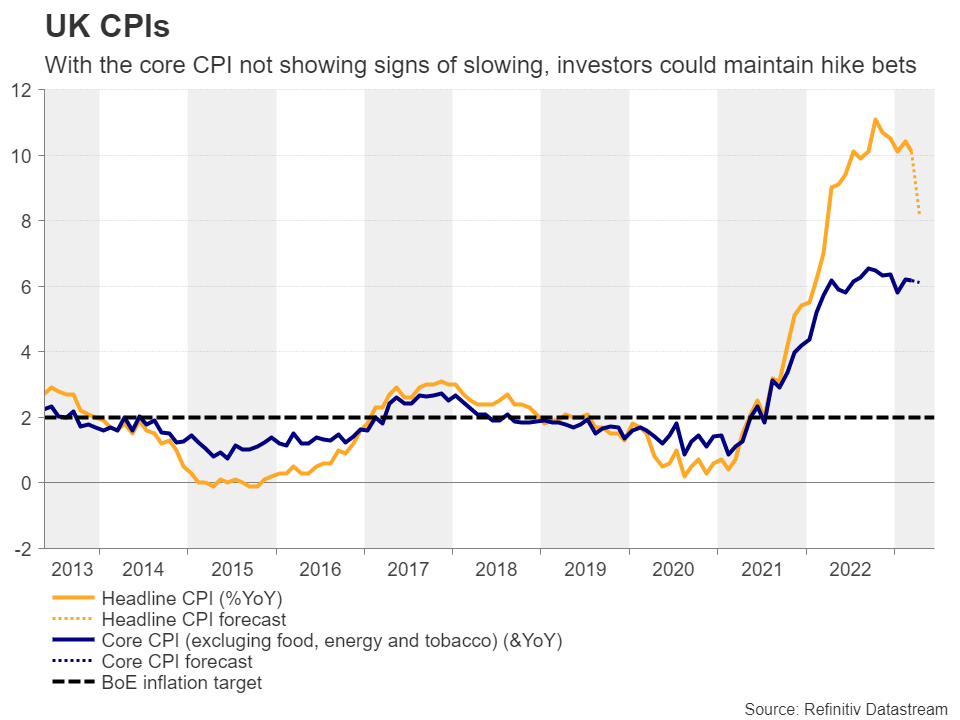

Blending this with Governor Bailey’s remarks that they must “stay the course” to ensure that inflation falls back to the 2% objective, investors were allowed to maintain bets of more rate increases in the months to come. Currently, they are assigning a nearly 80% probability for another quarter-point hike at the June meeting and expect almost one more by the end of the year.

Will the data alter those expectations?

Will the data alter those expectations?Although the manufacturing PMI remained subdued around 2 points below its equilibrium 50 barrier, pointing to contraction for the ninth consecutive month in April, the services index has been expanding for three months now, with April revealing a strong acceleration. This took the composite PMI up to 54.9 from 52.2. Further improvement in the May numbers could increase confidence that the UK economy has dodged a recession and thus, investors will remain convinced that more hikes are coming.

However, they are unlikely to play all their cards just a day ahead of the CPI data, as bringing inflation to heel is the BoE’s top priority. Both the headline and core CPI rates are expected to have declined in April, with the former slipping back below 10%, to 8.2% year-on-year from 10.1%, and the latter ticking down to 6.1% y/y from 6.2%.

That said, according to the April PMIs, price-charged inflation accelerated during the month as private sector firms once again sought to defend margins from rapidly increasing staff costs. This likely tilts the risks surrounding Wednesday’s data to the upside. That said, even if the forecasts are met, inflation would still be well above the BoE’s 2% target, with the core metric not showing signs of sufficient slowdown. For market participants to start scaling back their hike bets, a downside surprise may be needed.

On Friday, retail sales are expected to have contracted again in April, but at a slower pace than in March, which adds to the narrative that inflation may not have cooled down as the forecasts suggest.

Pound could stay in uptrend, especially against aussieThis could further convince investors that another hike is in the BoE’s chamber and that at least another one is likely to follow. Thus, even if the pound corrects lower next week, it could remain in a broader uptrend mode. Nonetheless, exploiting further pound gains against the dollar, which has been receiving massive support from US data and hawkish Fed rhetoric, may not be the wisest choice. With the RBA seen maintaining a soft stance after the disappointment in Australia’s employment report for April and stepping back to the sidelines in June, pound/aussie may be a better option.

Pound/aussie has been in a sliding mode today, after it hit resistance nearly the 1.8830 level on Thursday. However, even if the pair extends its retreat below last week’s lows of 1.8585, the bulls will still have the opportunity to jump back into the action from above the uptrend line drawn from the low of February 2.

If so, they may push for another test at around 1.8830, the break of which could pave the way for the peak of April 28 at around 1.9035. If they are not willing to stop there either, they would then enter territories last seen in February 2022, with the next resistance perhaps being the high of January 28 of that year at 1.9220.

For a bearish trend reversal to start being examined, pound/aussie may need to fall below the 1.8400 zone, which offered support last month. Such a slide may also take the pair below the aforementioned uptrend line and perhaps allow declines towards the low of March 31 at 1.8245.

相关资产

最新新闻

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。